New presses and evolving business practices in packaging will see aqueous inkjet printing inks achieve double digital growth across all packaging verticals over the next five years, according to new data from Smithers.

In a new market report, The Future of Water-based vs. Solvent Printing to 2027, Smithers is predicting that the total consumption of water-based inks will expand at a steady compound annual growth rate (CAGR) of 3.1% to reach 576,000 tonnes in 2027.

In contrast, solvent-based ink use will rise from 1.02 million tonnes in 2022 to 1.13 million tonnes in 2027, representing a significantly slower CAGR of 2.1%, by volume, for the forecast period. This is indicative of greater enthusiasm in multiple markets to invest in alternative ink types, the report has found. Both of these chemistries will compete against each other, and also against alternative ink systems – oil-based, radiation curing, liquid and dry toner.

With regard to aqueous chemistries, water-based printing is largely confined to a few sectors of the market – packaging, labels, commercial print and publications – and within these, there are distinct nuances due to an array of technology and market factors.

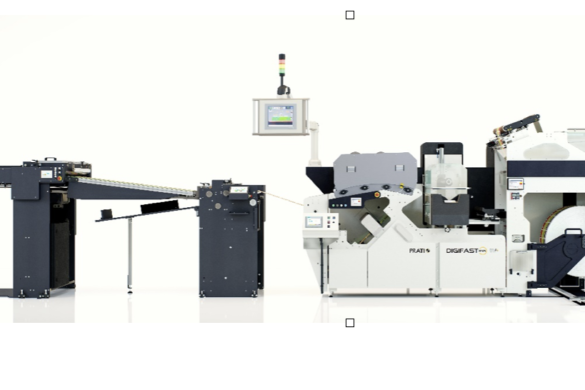

Several recent new press models for the packaging segment are based around aqueous inkjet. These are set to become increasingly important over the next five years, according to Smithers, as converters look to transition towards more paper-based packaging substrates. Whilst there will be scope for wider use over solvent ink systems, concerns over release of VOCs mean that water-based systems will be preferred as and when drying technology allows for these to run at an acceptable print speed. Water-based inkjet is especially attractive in food packaging given residual fears over the safety of radiation curing systems and the presence of unreacted ink components in particular.

For aqueous inkjet, Smithers forecasts double-digit growth in all packaging types, as new presses are installed and print buying moves towards a print-on-demand model.

For flexo there will be a gradual, but unspectacular, transition across most major packaging types – folding cartons, corrugated, and flexible substrates – supported by resurgent commercial printing demand. Solvent-based printing will remain common in flexo, mainly for longer run flexible packaging not used with food or other sensitive goods. This will also be the situation for gravure, although publication work remains an important, though diminishing, application for this process. Simultaneously, solvent inks will see some additional use on inkjet presses for packaging, but the largest application will remain in advertising work.

The market outlook for all major ink types in graphics, publications and packaging markets is examined authoritatively in the new Smithers market data study which includes an in-depth analysis of the competing advantages of the latest aqueous and solvent ink chemistries and how these markets will evolve across the next five years. Data is quantified (by volume and by value), segmented by ink type/base, end-use application and regional geographic market; and presented in over 250 data tables and figures.

For more details on the report click here

Caption:

Several recent new press models for the packaging segment are based around aqueous inkjet, such as Screen’s Truepress Pac 520P